One of the favorite sessions during SaaStock17 was David Skok’s keynote on the first day. The General Partner of Matrix Partners tackled the topic of what SaaS founders should focus on at each company stage they go through. A European entrepreneur turned VC in the US, David Skok’s wisdom fitted perfectly on the SaaStock stage.

Startups are a race against time. The way to win is an extreme focus and total alignment across all departments. Every single person needs clarity about what the company needs to do.

I like to take complex things and really simplify them. The hardest task for a CEO is to know what to focus on and to find alignment in the organization so that everyone is pulling their weight toward the same goal.

In the case of SaaS, each company goes through three main stages of development:

1. Search for PMF

2. Search for repeatable, scalable, and profitable growth models

3. Scaling the business

Problems and mistakes at each stage

1. PMF stage: Not enough time with customers before building the product

It’s really hard to cold call and find customers who will take a meeting. If you’re a product person or an engineer, it’s even harder. That’s not your strong suit, maybe. The result of too little time with customers?

- The product doesn’t quite fit

- The product is good enough to get interest, but can’t close deals

- Lots of wasted time fixing all these pieces and burning cash

2. Finding scalable and repeatable models: Urge to jump ahead to scale before the business is ready

Rushing this can manifest in a number of ways:

– Hiring salespeople before founders have figured out how to sell the product – salespeople will not be able to sell your product without the inherent passion depth and knowledge that founders have. It is vital for founders to figure out how to close the first deal.

– Scaling sales before solving a churn problem – this could cost a ton of capital because regardless of what the salespeople are doing, something else is driving customers away.

– Scaling sales before the growth process is predictable and repeatable – without a reliable process, salespeople will burn a lot of time and the more the salespeople, the slower change to the process is. However, if the team is still small, changes to the process and altering strategies, is much easier and less costly.

3. Scale stage: Founders remain in burn avoidance mode

Founders become so used to saving money and not hiring people that it may be scary to go into the next mode. If you have found the scalable, repeatable, profitable models, you should be putting your foot on the gas!

People underestimate recruiting; they think it’s secondary. You can’t afford not to be great at recruiting.

The underlining theme during each stage is cash!

- When will we run out of cash?

- Are we on track to reach the milestones needed for a successful fundraise?

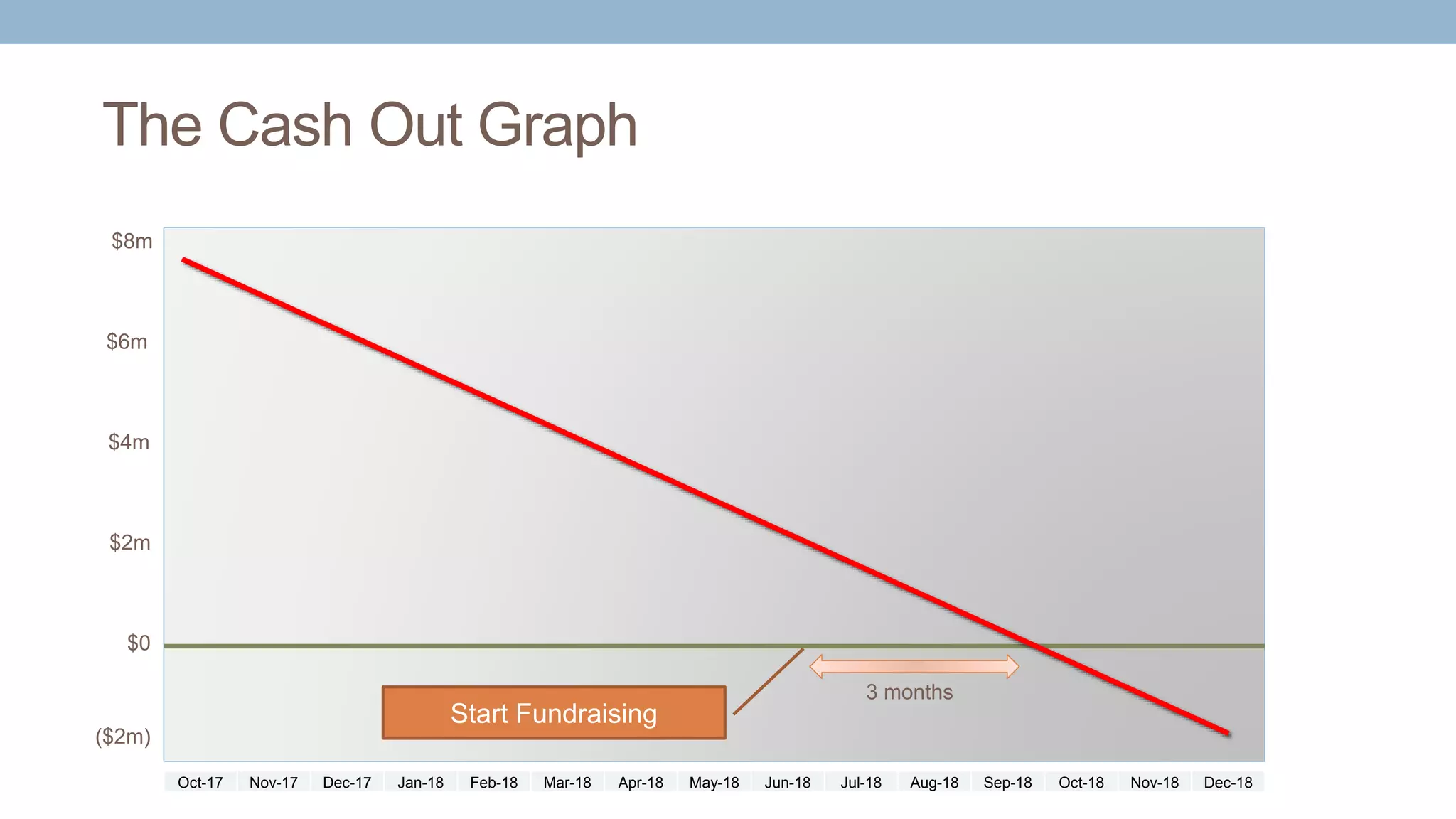

The Cash Out Graph

Courtesy of David Skok

The answers to these questions and the eventual cash out graph that they produce are the most important aspects of each board meeting. Being clear on the answer creates a sense of urgency and time pressure. You may realize you have too much to do, and it forces you to cut some things out and focus. Then you can show this graph to your team to align everyone behind certain goals.

About three months before cash out, you want to start fundraising. But I heard this might take longer in Europe. If so, I feel sorry for you!

Since cash is crucial to survival, it’s important to understand what are the milestones to achieve to “unlock” more cash. The perception often is that valuation increases over time, inevitably.

This is wrong.

Valuation can go down because the company isn’t showing any new results. Startup valuations move in lumpy jumps, based on when you reach different milestones.

How does that look in the stage when a company founder is looking for repeatable, scalable, profitable growth models and looking to raise Series A? Investors will look for a few key things:

- Good evidence of PMF

- Customers have purchased and happily refer you

- Customers are using the product and don’t want to (can’t) give it up

- They are well aware of promised benefits and realize the value

- Customers show intent to expand their account

- Churn is low

Note that to get a Series A, a scalable model isn’t necessary, but demonstrating PMF is vital. Once you have the good evidence for PMF, you should focus on four key aspects.

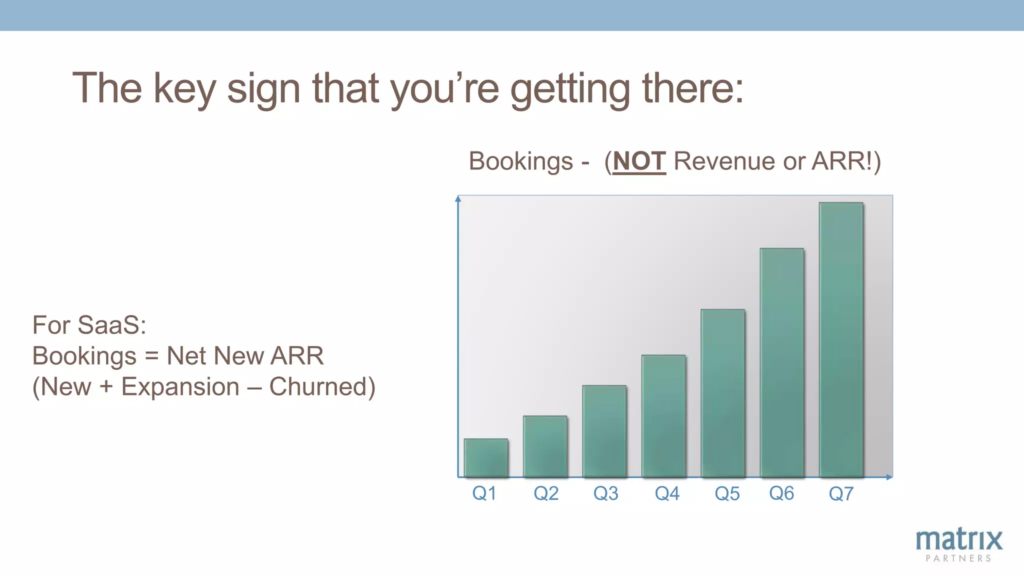

1. Consistent growth in bookings

A key sign that you’re getting there are growing bookings. The important thing to keep in mind – bookings are NOT plain revenue or ARR. They are rather the Net New ARR, which you get by adding New ARR and Expansion ARR together and subtracting the Churned ARR.

2. Proof you can grow sales org and make them productive

There is an unfortunate truth in sales – 1 in 3 salespeople will fail. Hiring the good ones is particularly difficult. Both make this milestone a huge challenge.

When you have salespeople, it’s not just about whether they hit the quotas here or there. You want to know:

– How successfully are they ramping up?

– How reliably are they producing their results?

– How is success distributed across the sales team?

What I don’t want to see is two superstar salespeople and the rest not performing well. That’s common.

A few things you can do to get a better idea how your sales organisation is doing and improving:

– Measure Productivity Per Rep, and see how that is distributed across the team over time.

– Measure the % of reps above quota, over time. If it goes up and to the right, that shows you are growing and training your team well, you have found good processes that are repeating and can expect predictable results.

3. Proven lead sources

No point in a successful sales team if they don’t have the right leads.

4. Profitability

You will have to show profitability. Two good indicators are if LTV is more than 3xCAC and the CAC recovery period is less than 18 months.

View David’s full presentation from SaaStock17: