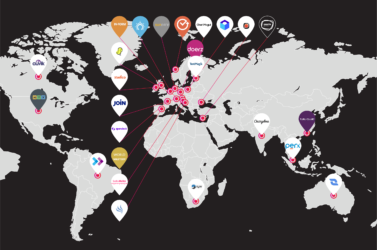

If you sat down looking for the top VCs investing in SaaS in the U.S., you might get the impression that they flock to California. To be fair, this is not an overestimation.

However, things are changing. The East Coast is growing up to be a fair competitor to the tech hubs concentrated on the West Coast. A significant part of this development, naturally, is due to the presence of trustworthy investors in states like New York, Massachusetts, Virginia, Georgia, Florida, New Jersey, North Carolina, as well as Washington D.C. If you’re wondering where to base your SaaS company — or where to scale it in the U.S. — you certainly have good reasons to give the East a chance.

We’ve gathered for you the 28 most exciting SaaS investors from the East Coast. Don’t miss our SaaStock on Tour New York on June 20th where you’ll have the opportunity to meet some of them and get connected with the local ecosystem.

New York

Bessemer Venture Partners

Bessemer Venture Partners was founded more than 100 years ago, making it the oldest venture capital firm in the U.S. It has funded present-day success companies like LinkedIn, Pinterest, Blue Apron, and many more. In its portfolio, it has over 100 SaaS companies. Bessemer Venture Partners invests in businesses at all stages — from seed to growth. Its main interests are in consumer, enterprise, and healthcare innovations.

City: Office in NYC

Founded: 1911

Size of fund: $3.6B

Stage: Debt, Early Stage Venture, Late Stage Venture, Private Equity, Seed

SaaS Investments: Virtru, Pipedrive, Shopify

Boldstart Ventures

Boldstart Ventures is the first name that comes to mind for financing technical enterprise businesses. Since 2010, the company has funded more than 60 enterprise startups. Boldstart partners with a number of Fortune 500 CIOs and CTOs to help its portfolio companies accelerate their development and get to a winning product-market fit.

City: NYC

Founded: 2010

Size of fund: $64.9M

Stage: Seed

SaaS Investments: BigID, IOpipe, and others

Bowery Capital

Among the early stage VCs on the East Coast, it’s worth mentioning Bowery Capital. The firm invests in businesses that create emerging B2B technologies which transform their fields. Bowery Capital’s Acceleration Team helps portfolio companies with successfully handling their sales, marketing, and customer success operations.

City: NYC

Founded: 2013

Size of fund: $93M

Stage: Early Stage Venture, Seed

SaaS Investments: VNDLY, ActionIQ, and others

Insight Venture Partners

With a substantial fund size and 23 years of experience, Insight Venture Partners is one of the most established, largest and fastest-growing VC firms that invest in software and internet businesses around the globe. It supports more than 300 portfolio companies with their operations and scaling, and has conducted 200+ M&A transactions.

City: NYC

Founded: 1995

Size of fund: $18B

Stage: Debt, Early Stage Venture, Late Stage Venture, Private Equity, Seed

SaaS Investments: OwnBackup, SalesSoft, and many others

Laconia Capital Group

Laconia Capital Group is a full-service venture capital company that invests in B2B tech companies based in New York, Philadelphia, Boston, and Washington, D.C. metro areas. Its focus is on late seed-stage businesses. The typical initial investments range between $250,000 to $1 million. Laconia also operates a family of early-stage funds and a venture asset management company.

City: NYC

Founded: 2015

Size of fund: N/A

Stage: Early Stage Venture, Seed

SaaS Investments: Ocrolus, PromoteIQ, and others

Mesa Ventures

Mesa Ventures invests in internet and enterprise businesses in the early stages. It also provides social capital and resources to the companies it funds, so that it supports them with growth and business development. Mesa Ventures focuses on e-commerce, advertising, media, enterprise software, and mobile solutions. It makes co-investments between $50,000 and $250,000.

City: NYC

Founded: 2012

Size of fund: $10M

Stage: Early Stage Venture, Seed

SaaS Investments: Abra, Clique, and others

New Enterprise Associates

New Enterprise Associates (NEA) is among the most well-known global venture capital firms, with more than 40 years of experience. It invests in biotech, energy, healthcare, medical devices, and SaaS businesses. NEA provides funding for companies at all stages — from seed to IPOs.

City: NYC, Chevy Chase, MD, and Timonium, MD

Founded: 1977

Size of fund: $13.3B

Stage: Debt, Early Stage Venture, Late Stage Venture, Post-Ipo, Private Equity, Seed

SaaS Investments: Hearsay Social, SCI Solutions, and others

Northzone

Besides its European offices in Copenhagen, Oslo, and Stockholm, Northzoneis also present in the U.S. In its more than 20 years of investments, the VC firm has funded more than 120 promising businesses. Its team is well acquainted with the challenges faced by startups both at the early stages and at later growth stages. That’s why Northzone offers extensive operational and network support.

City: Office in New York City, based in Sweden

Founded: 1996

Size of fund: €350M

Stage: Early Stage Venture, Late Stage Venture, Private Equity, Seed

SaaS Investments: Red Points, and others

Union Square Ventures

Union Square Ventures has supported present-day internet stars like Twitter, Tumblr, and Zinga. The VC provides early stage, growth capital, late stage, and startup financing. Union Square Ventures has a strong interest in applications, internet services, and mobile. The initial funding is usually $1 million, with $20 million overall investment in a single business.

City: NYC

Founded: 2003

Size of fund: $966.8M

Stage: Debt, Early Stage Venture, Late Stage Venture, Seed

SaaS Investments: Dwolla, Cloudflare, Return Path

Work-Bench

Work-Bench is an NYC-based venture capital fund that invests in enterprise tech businesses. It’s favorite topics include Big Data, advanced analytics, enterprise infrastructure, machine learning, and security, among others. Work-Bench provides its portfolio companies with a valuable network, common workspace, and access to enterprises for product validation.

City: NYC

Founded: 2013

Size of fund: $10M

Stage: Early Stage Venture, Late Stage Venture, Seed

SaaS Investments: Kensho, x.ai, and others

Massachusetts

Bain Capital Ventures

Bain Capital Ventures is one of the biggest investors in SaaS on the East Coast. It’s a corporate venture capital firm. Bain Capital has a proven track record of financing businesses with innovative tech ideas and helping them grow — and even get to exit. Investments range from $1 million of seed capital to $100 million of growth equity.

City: Boston, MA

Founded: 2001

Size of fund: $3.2B

Stage: Early Stage Venture, Late Stage Venture, Seed

SaaS Investments: DocuSign, InfoScout, TellApart, and many others

Battery Ventures

Battery Ventures is one of the oldest and largest tech investors on the East Coast. It offers financing at all stages — from venture capital and private equity to debt financing for promising technology companies. One of its current focuses in on SaaS market businesses. Battery Ventures is based in Boston, but has offices in the Silicon Valley and in Israel.

City: Boston, MA

Founded: 1983

Size of fund: $6.8B

Stage: Debt, Early Stage Venture, Late Stage Venture, Private Equity, Seed

SaaS Investments: BladeLogic, Bazaarvoice, Coupa, and others

General Catalyst

General Catalyst is among the largest venture capital firms on the East Coast. It invests in bold founders that aim to transform the field they are entering. General Catalyst provides financing paired with an extensive network and mentorship support. It has more than 580 investments to date, with 98 exits.

City: Cambridge, MA

Founded: 2000

Size of fund: $6.1B

Stage: Early Stage Venture, Late Stage Venture, Seed

SaaS Investments: SignalFx, Shift Technology, and others

Matrix Partners

Matrix Partners concentrates its investments in seed and early stage tech and internet businesses. With its over 40 years of funding promising startups across both coasts, the firm has the knowhow to boost the potential of its portfolio companies. While it’s headquartered in Palo Alto, Matrix’s Boston office is as active and is an important player on the East Coast. Matrix Partners currently focuses its funding on B2B, infrastructure, and consumer technology.

City: Office in Boston, MA

Founded: 1977

Size of fund: $1.9B

Stage: Early Stage Venture, Seed

SaaS Investments: Zendesk, Namely, and others

NextView Ventures

NextView Ventures offers seed-stage funding for businesses “redesigning the Everyday Economy.” It aims to finance the development of products that are tech-driven and are in the fields of food, housing, apparel, transportation, health, work and money, and entertainment. The checks range between $100,000 and $1 million.

City: Boston, MA and NYC

Founded: 2010

Size of fund: $111M

Stage: Debt, Seed

SaaS Investments: The most recent is InsightSquared

OpenView

OpenView is a venture capital firm that finances expansion stage software companies. Among its top investments are Instructure, Kareo, Datadog, and Expensify. OpenView provides businesses with hiring, acquisition, customer retention and partnership support after investment.

City: Boston, MA

Founded: 2006

Size of fund: $992.8M

Stage: Debt, Early Stage Venture, Late Stage Venture

SaaS Investments: Datadog, Calendly, Logz.io, and a number of others

Polaris Partners

Polaris Partners invests in visionary businesses in technology and healthcare. Among its tech focus are SaaS companies as well. With its 20+ years of investment experience, Polaris Partners funds businesses at all stages of development. The important factor is that they carry the promise of becoming world leaders in their fields, which is also illustrated by the firm’s impressive portfolio.

City: Boston, MA

Founded: 1996

Size of fund: $4.3B

Stage: Early Stage Venture, Late Stage Venture, Seed

SaaS Investments: Kissmetrics, Jibe, Confluence, and many others

Summit Partners

Summit Partners is a global alternative investment company. It provides funding through growth equity, fixed income and public equity opportunities. To date, Summit Partners has invested in more than 460 companies in fields like tech, healthcare, and life sciences. It also helps businesses with strategic and operational advice and recruiting.

City: Boston, MA

Founded: 1984

Size of fund: $9.5B

Stage: Early Stage Venture, Grant, Late Stage Venture, Private Equity, Seed

SaaS Investments: The most recent is Signavio

Washington, D.C.

Acceleprise

Acceleprise focuses its investments on early stage enterprise tech businesses. The accelerator started out in Washington, D.C. to meet the acute need for early stage investors. It expanded to San Francisco later on. Its current offer is mainly for pre-seed SaaS companies.

City: Washington, D.C.

Founded: 2012

Size of fund: $10.5M

Stage: Early Stage Venture, Seed

SaaS Investments: Lightning AI, Allbound, and many others

SaaS Ventures

SaaS Ventures is one of the newest investors in SaaS on the East Coast. It’s a venture capital firm that focuses on seed-stage enterprise technology companies. SaaS Ventures typically make co-investments, but also help their portfolio businesses with finding other co-investors and next stage investors. Its typical checks are in the range of $750,000 to $3 million.

City: Washington, D.C.

Founded: 2017

Size of fund: $10M

Stage: Early Stage Venture, Seed

SaaS Investments: Huntress Labs, Airside Mobile, Ataata, and Insightin Health

Georgia

Atlanta Ventures

Atlanta Ventures is the brainchild of David Cummings. It’s a seed accelerator for SaaS businesses based in Atlanta. Atlanta Ventures helps companies with much more than capital: it also provides them with a community of like-minded peers, mentors and investors, as well as with access to a ton of useful content resources for their development.

City: Atlanta, GA

Founded: 2012

Size of fund: N/A

Stage: Seed

SaaS Investments: The most recent is Terminus Software. Others include Calendly and Cardlytics.

Fulcrum Equity Partners

Fulcrum Equity Partners is a growth equity company. It focuses its investments in high-growth SaaS, tech-enabled services, healthcare services, and healthcare IT businesses. Fulcrum Equity Partners has already funded more than 30 companies across these sectors. The team provides support to its portfolio businesses with its rich experience in accounting, law, investment banking, operations, and strategy consulting.

City: Atlanta, GA

Founded: 2006

Size of fund: $336.1M

Stage: Early Stage Venture, Late Stage Venture, Private Equity

SaaS Investments: SaaSOptics, Synthio, and others

Tech Square Ventures

Tech Square Ventures takes its name from its location. It’s based in the Technology Square in Atlanta and focuses its activities in the Southeast. The firm funds seed and early stage companies developing promising solutions in areas like cloud, IoT and university spinouts.

City: Atlanta, GA

Founded: 2014

Size of fund: N/A

Stage: Early Stage Venture, Seed

SaaS Investments: Cypress.io, Salesfusion, and others

Florida

Citrix Systems

Citrix Systems is a large East Coast tech company that is known around the globe. It creates Workspace-as-a-Service, application delivery, virtualization, mobility, network delivery and file sharing solutions. Citrix focuses on ensuring security in data and app delivery. It also provides financing to promising tech businesses, which also includes SaaS.

City: Fort Lauderdale, FL

Founded: 1989

Size of fund: N/A

Stage: Seed, Early Stage, Late Stage

SaaS Investments: HiveIO, AnyPresence, and others

TheVentureCity

TheVentureCity is no typical accelerator. It’s based on the idea that companies should receive the widest possible support, paired with financing. It makes investments in fintech, healthtech, enterprise software, marketplaces, and SaaS. The main technologies that TheVentureCity fancies include AI, machine learning, VR and blockchain.

City: Miami Beach, FL

Founded: 2017

Size of fund: $100M

Stage: Seed, Early Stage Venture

SaaS Investments: Pixlee, and others

New Jersey

Edison Partners

With 32 years behind its back, Edison Partners certainly knows a lot about investing in the right companies. The growth-equity firm focuses on promising tech businesses from the East Coast. Edison Partners provide their portfolio companies with financing, as well as thorough support through the Edison Edge platform. It invests in fintech, healthcare IT, enterprise IT, and marketing tech.

City: Princeton, NJ

Founded: 1986

Size of fund: $924M

Stage: Early Stage Venture, Late Stage Venture, Private Equity

SaaS Investments: Terminus Software, and others

Virginia

In-Q-Tel

In-Q-Tel is a special entry on this list of SaaS investors. It is a non-profit investor that bridges the government agencies that seek innovative security solutions and high-potential startups that develop them. In-Q-Tel provides financing and support for developing cutting-edge technologies that can be used in organizations like the CIA. its focus is on funding promising companies in the field of infrastructure, bio tech, communications, cybersecurity, data analytics, and IoT.

City: Arlington, VA

Founded: 1999

Size of fund: N/A

Stage: Debt, Early Stage Venture, Grant, Late Stage Venture, Seed

SaaS Investments: Paxata, Enveil, and others

North Carolina

Excelerate Health Ventures

Excelerate Health Ventures is a healthcare IT focused fund with an emphasis on investing in seed and early stage healthcare software and services startups with a SaaS B2B model. The EHV management team is comprised of experienced healthcare entrepreneurs with operating expertise in growing startups.

City: Raleigh, NC

Founded: 2014

Size of fund: N/A

Stage: Early stage

SaaS Investments: NurseGrid, and others

Southern Capitol Ventures

The geographical focus of Southern Capitol Ventures are the Southeast and Mid-Atlantic regions. It invests in technology companies at the early and mid-stages. Of particular interest are businesses developing solutions in e-commerce, software, digital media, wireless, mobile, and healthcare.

City: Raleigh, NC

Founded: 2000

Size of fund: $15M

Stage: Early Stage Venture, Late Stage Venture

SaaS Investments: Zift Solutions, AVIcode, and others

Excited about SaaStock on Tour New York already? Make sure you check out our 28 superstar speakers that’ll share their wisdom with you on June 20th in NYC’s Knockdown Center. Grab your ticket before we run out of them.