SaaStock Day 2

Wednesday 17 October

You can’t be everywhere at once. That’s why we’ve created SaaStock Live, our on-the-go recaps of key sessions throughout SaaStock 2018. Our reporters, Annie and Despina, will keep you up to date and fill you in on exciting SaaS you might have missed.

You can also follow along on Instagram and Twitter!

_____________________________________________________________________________

18:00 And the Best SaaS Startup for 2018 is…

Congratulations to Christina Vila, CEO and Founder of Cledara

Big thanks to our judges and all startups who took part.

16:20 – Enabling sales to be your secret weapon

Stan Massueras, EMEA Sales Director at Intercom

Scale Stage

Stan started his sales career in 2003 in B2B companies such as Hewlett-Packard before joining disrupters such as Facebook and Twitter in 2008 as one of their first European Sales Leaders. Since, Stan built multiple sales teams from the ground up. He launched his own company (Pulp) in 2014 and joined Intercom 18 months ago as their EMEA Sales Leader in Dublin.

Businesses need to find the right balance between smart automation and personalization. in order to cut through the noise and accelerate their growth

90% of startups fail within three years

50% never raise a first round

These are hard statistics to read. They cause a panic. You think, in order not to become one of these statistics, you need to focus on your product. You need to offer the best product on the market.

But really what you should be thinking about is: How are you going to beat your competitors to market?

It won’t be a certain feature or functionality. The truth is that your product probably won’t sell itself.

In this day and age, your sales team is your key differentiator.

Stan introduced us to a dark secret of the world of entrepreneurship: Flippa.com. It’s a market place for online businesses, where broke companies go to make one last profit. They sell themselves for a couple thousand, or even just a couple hundred, euro.

He outlined the trends in tech companies appearing on Flippa.com

2 years ago: Mobile apps

Recently: Cryptocurency

Now and upcoming: SaaS products. Oh no!

Keep your company off Flippa.com by focusing more on customer acquisition, not product development. Your revenue will keep the product alive, not its functionalities.

SaaS is neglecting sales strategy

Pretty often, Stan goes onto G2Crowd and checks his company’s vertical: Live Chat. Every time he sees the number of Live Chat product offerings growing. He gets paranoid.

What he realizes, and what you should, too, is that your software is just a commodity. Commodities are, by nature, replaceable! Your product is not that special.

Many SaaS companies double-down on their marketing efforts to make their product or brand seem more special. Everyone has a blog or a podcast. There’s a lot of marketing noise.

And since everyone is either focusing on product development or marketing, they are neglecting sales. SaaS startups don’t have a clear sales strategy from day one.

Key elements of any sales strategy:

- Your product solve a problem

- Your product is simple to implement

- Your branding that conveys credibility and trust

- Your sales team that is faster and more creative than competitors

About being fast

Stan said at Intercom, they used to measure first response time. It was two minutes. “If we’re the first ones to engage, we’re likely to win the deal,” he said.

But six months ago, they implemented “Real Time Sales” – an Intercom tool for sales speed and personalization at scale.

With Real Time Sales, they’re trying to mirror the customer experience of the Apple store. You’re greeted at door, ask for assistance, speak with an expert, thanked for your purchase, and receive best-in-class follow-up customer support.

Inbound sales

Intercom has automated greetings specialized on various landing pages. Visitors can book demos or webinars in real time.

They send personalized videos for a demo, or for thanking a signup. These videos feature real employees. There’s a sense of human-to-human connection, even if no real-time human effort is employed at your company.

Even after the sale, Intercom focuses on engagement. They send a video message (about 45 seconds long), showing how a specific product could impact their website, what it would look like. This has been really powerful to drive adoption of different features.

What about outbound??

There’s an important difference between the customers you want and the prospects who are a good fit. Focus on the latter! Capture the low-hanging fruit first, then move on to more ambitious targets.

Iterate your sales strategy based on customer data

Every month, Stan and his team look at customer segmentation to see the most loyal users and who has highest growth in last six months. In other words, they identify who sees the most value with Intercom. And then they ask, “What do they have in common?”

Stan segments their customers by:

- Alexa score

- Level of funding

- Vertical

- B2B/B2C

- Number of employees

- Tech-stack

Do video on the cheap

Even though Intercom is huge and has plenty of cash, they build their video content in scrappy way. So can you. In fact, the more homemade and authentic it looks, the better engagement you’ll get.

They use a Logitech camera, and their own laptop. They also use the following online tools:

- Quicktime free

- Wistia free

- Vidyard free

- Livestorm

- iMovie Free

- Giphy Free

Results from personalized video in sales process:

- 52% increase of communication engagement on every channel, email or in-app messages.

- 31% Reduced time to close! Massive productivity increase for the rest of the team.

- Spendesk reduced sales cycle by 24% in 3 months.

- Aircall: personalized video in email outreach improved response rate by 58%.

Final words from Stan

- Let automation manage your repetitive sales tasks.

- Be creative, go deeper with personalization

- Focus on speed. The best product does not always win.

– Annie

14:00 Nap time (for some)

.@SaaSOscar she’s all tuckered out after a morning repping @SoapBoxHQ at #SaaStock18 … thank you to you, Emma, Irina, Alex, Sarah and the rest of the team for the warm welcome of the youngest @SaaStock-er pic.twitter.com/gJDiOYJtae

— Jessica Weisz (@WeiszJess) October 17, 2018

For the rest, sleeping is for tomorrow

Thank you for having me @saastock

The one thing I want everyone who attended my session to take away…. You, your company or your product are not the hero in the story. Your customers are. So find those hero’s and make them rockstars! #saastock18 pic.twitter.com/wVZrb7ApZ3— Jada Balster (@JadaBalster) October 17, 2018

🎶 Stop. Collaborate and… take over the world! 👊 @JudyMailjet reinforces the importance of collaboration as a route to success @SaaStock #SaaStock2018 @mailjet pic.twitter.com/JbyfkMXHZu

— Sunderland Software City (@SunSoftCity) October 17, 2018

13:15 – Meet the investors: What do growth investors look for?

Jos White, General Partner at Notion Capital

Michael Brown, General Partner at Battery Ventures

Nicola McClafferty, Investment Director at Draper Esprit

Tom Mendoza, Venture Investor at EQT Ventures

Scale Stage

Growth investors are looking through a different lens for Series B/C rounds as compared to earlier stage venture investors. These growth investors discussed how they make decisions and what they see as the key drivers of a high-quality growth round.

What’s one top thing you look for at growth stage?

Michael: Can you get at least 1x euro back?

Tom: Is there an executive team in place who can scale? If not, what’s the roadmap to getting there?

Nicola: Do you know how your customers behave, and have you matched your sales and distribution model to that? That’s the engine that ensures you can scale. The next question is, “Can you adapt it internationally?”

Michael: On that note, we look at the pull/push dynamic around your product. Ideally at this stage, the market is pulling your product. It’s not just you pushing your product to the market.

Jos: Right. Before series A, you can evangelize and get early adopters. But with series B, you need the market to pull. You need a product that’s mission critical to your users. That’s the only way you can scale effectively.

Are there any parameters for a series B investment, such as check size, level of revenue, or growth valuation?

Michael: We don’t have any hard-and-fast metrics. Some firms do. We’re about the opportunity and the vision, and how big it could be. Depending on the revenue scale, we’ll figure out the right metrics to evaluate. We look for $1M run rate per quarter as an ideal minimum for the next stage of investment. The larger you are, the more metrics we have to evaluate, and its easier for us to connect the dots.

Nicola: We work more with ballparks than hard-and-fast rules. Of course we look for paying customers and market adoption; we want to see that momentum. But also, you expect a B2B software to use their Series A effectively. So we look at proof points to see how they’ve transformed their processes since the previous raise.

Tom: We like to see the magic ratio of marketing and sales, which is above one. Churn is great indicator for validating PMF.

Much of a series B round is spend on hiring people, whether C or VP level. They’re hiring real game changers. How do you gauge whether the company is capable of spending millions on the right hires?

Nicola: Of course, we are always backing a founder at the earliest stages. So at this stage, we spend time going deep with the founder/CEO about the people roadmap. We want to see the gaps and understand their thinking about how to fill them. Also, we do help on the hiring side. In order to help, we want to know: what does the bench look like?

Micheal: Ideally with a first time founder, you have members of the senior team who have done it before. For example, the CRO or VP of sales have scaled a company before.

You also need the founder/CEO to be flexible, to have a willingness to change the team. The person who gets you from $5 to $10M might not get you from $10 to $50M. Then that person may not get you from $50 to $100M. You have to me capable of making the necessary people changes.

Tom: We look at the open processes underway. What are the searches he’s actually undertaking, rather than promises of what’s to come?

With pre-series B companies, do you like to see a senior team where some of the transformational hires have already been made?

All three investors: For us, it’s not a criteria. If they haven’t made any of the key hires yet, we can help them.

How can you know if a company’s going to scale the way you expect?

Michael: It’s about how they think. Is the founder/CEO a structured, analytical thinker? When you’re small, you can hack through without much critical thinking. But going from 50-100 people then to 400 people, you have to be more analytical. If you inherently have that analytical framework and approach, then you can probably scale.

Nicola: It’s also about decisiveness. You have to make the right calls at the right time. As a founder/CEO, you have to move away from loyalty and into the execution stage.

Jos: I can add that we look to see if the founder/CEO is capable of self-awareness and brutal honesty with their team.

Tom: We have honest conversations with them to realize where they might have gaps in ability or experience, and we choose the right advisors to surround them, support them properly.

At series B, do you still expect growth at all costs? Or is the business reaching a level of maturity where you can follow a path to profitability?

Michael: Do the unit economics work? Will those unit economics translate into profits? Depending on the market opportunity, you may want to spend a ton and capture the whole thing. But there are other markets where it isn’t “Winner Takes All.” So, it’s case by case.

Fundamentally, companies are valued by cashflow. So we want to see core economics. And if that’s reliable, then we’ll figure out what rate of growth is right.

Tom: I agree. We need unit economics in place, plus an undeniable PMF.

12:30 – Ten lessons I learned growing past $40mm in ARR

Vivek Sharma, CEO of Movable Ink

Scale Stage

Vivek co-founded Movable Ink in 2010 and has led the company through rapid growth to a leading market position with 200+ employees serving 500 of the most innovative consumer brands. Movable Ink is helping digital marketers embrace a visual world with intelligent creative that adapts at the moment of engagement.

Many SaaS companies have stall points around $10M and $30M in ARR. At $10M, companies crumble if they haven’t figured out a scalable sales process. At $30M, companies crumble if they haven’t figured out a scalable organization.

Movable Ink recently crossed $40M in ARR. Vivek Sharma shares their 10 biggest lessons.

1. Product

Introducing a new product? Shrink down to startup.

The scaled company is risk adverse. When you get to a huge organization, each member has their own priorities they want to protect. The sales rep has a bookings target to hit; he doesn’t want to be your guinea pig. Others don’t want to jeopardize a client relationship with talk of a hypothetical product. There’s resistance to change and new products.

So create special teams that are like an internal startup. Movable Ink created “tiger teams,” with one sales rep carrying a custom quota for this product, one marketer, etc.

99% of people you hire have never had to sweat through an MVP process. Select the right few to build a separate team for this new product.

(On this note, a book recommendation from Annie: a classic, The Innovator’s Dilemma)

2. Sales

Discover your own first principles.

There are so many gurus and holy grails to follow about how to run SaaS sales.

“Applying other playbooks to your product and your buyer can cause things to go royally sideways.”

So first do some discovery within your own business. ABM, NQL, BDR aren’t the answer.

Ask yourselves: “Who is our buyer? Who do they need to talk to?” Learn for yourself what your buyer looks like and how their process works. Then design a sales process (or adapt one of the playbooks) to that.

3. Customer Success

Your Customer Success manager should be your most seasoned manager.

Customer Success is so crucial to SaaS. You need to take this hire very seriously.

“I was hiring player coaches before this. But I realized I needed a real manager who had built an organization before and could train people with raw talent.”

Vivek admitted that executive recruiters cost a fortune (Movable Ink paid $80-100K), but it was worth it. Vivek wasn’t limited to just his own professional network, and he had his pick of people who could be a good fit.

Proof of value? The person he hired six years ago to be the VP of Customer Success is now the Chief Revenue Officer.

4. Marketing

Embrace marketing without clear-cut ROI

“Everyone is reading the same blog posts and books. If everyone is reading the same playbook, then it’s not an advantage.”

To develop a strong brand and break through all the marketing noise, you need to live without the certainty, without the quantified data. Eventually you can track the ROI, but you have to make a leap first.

Example? Movable Ink put together an event strategy. They created a road tour, which put together 60-70 people to do a presentation. This eventually grew into hosting their own customer conference!

5. Partnering

Arm a bigger company with a slingshot

When it comes to partnerships, aim big. As the fresh new addition, you can be the slingshot for bigger companies to take down their competitors!

In return, you get involvement and momentum in front of a greater audience. Maybe it will take a couple years to see the full benefits.

6. People

Know how to evaluate hires. The secret to hiring A players.

For a long time, Movable Ink employed what Vivek calls “voodoo hiring.” Which is to say, incredibly subjective, wishy-washy hiring, hoping for the right result. With a disorganized interview process, every interviewer will come away with their own different impression.

Now for Vivek’s own book recommendation!

The book has a framework that you can put into practice. You’ll learn how to unify ideas of what you’re hiring for, train people on how to interview properly, and align candidates on a scorecard.

7. Finance

Hire a CFO before $10M in ARR who has SaaS experience

“Don’t hire someone who needs to learn SaaS on your dime.”

Your CFO needs to know what the SaaS numbers mean. Movable Ink had close calls in the past because the head of finance didn’t understand SaaS accounting or projections.

“It’s not just about numbers, but also intuition. A SaaS-experienced CFO can help you know when to hold back on investments, or when to double down.”

Plus, a CFO can also be your operational partner in any area that makes the machine run: legal, finance, IT, operations, etc.

8. Operations

Establish a decision making framework

“I became an obstacle to getting things done.”

When the business is smaller, you (as the founder or CEO) have to be involved in nearly all decision. But as you grow, you don’t.

Be clear about what decisions you need to be involved in, and which you don’t. Know where you need to decide, and where you simply need to give input.

9. International

Follow the breadcrumbs of those who’ve come before you

Europe has advantage because European SaaS needs to think about going global from day one. As an American company, Movable Ink followed the path and roadmap of other successful companies, so as to avoid their mistakes.

Vivek also encourages: don’t be afraid of markets that seem difficult to crack. The Japanese market intimidated him at first, but turns out the market was really receptive to what Movable Ink offered.

10. Growing as a leader

Push yourself to grow every year

“Your company will follow.”

Find some form of professional development or getting out of your comfort zone. Look into finding an executive coach, but be very picky.

“It’s a rare thing to build a dream team. Cherish it. Embrace every success and celebrate it!”

12:00 – Meanwhile, on the SaaStock grounds

10:30 – Building a global business starting from Europe: Lessons from scaling go-to-market across continents

Teddie Wardi, Principal at Insight Venture Partners

Martin Henk, Co-Founder of Pipedrive

Christian Owens, CEO of Paddle

Scale Stage

This panel focused on how European SaaS companies can play to strengths and manage weaknesses that come with starting here and expanding there, wherever “there” is.

Martin, about his company Pipedrive: We provide software for sales. If you’re selling something expensive that takes a while to close, Pipedrive is for you. The company is 8 years old and now in 170 countries. We started in Estonia. Our headquarters are still there, but we also have offices in NYC, London, Lisbon, and Prague.

Christian: Paddle is a recurring billing infrastructure for SaaS. We’re 140 people in London, and we’re about to open our first international office. But we focused on growing an international business before building an international company. Only 3-4% of revenue actually comes from London.

Martin, how did you decide to expand globally?

M: When you’re from a country that has only 1.5 million people, going global is the only way forward! You need to find a bigger market. We always wanted to go global, which is why we made our product completely self-service and in English. Actually our second customer was from the US.

Christian, many of your peers have gone global earlier. Was waiting a conscious decision for advantages, or is it a planning flaw?

C: I find that often, with venture-backed software, the excitement to expand to the US comes at the expense of the European business. We wanted to build and scale a strong European business, rather than work other markets in parallel. Now we have the infrastructure in place to grow.

Of course, North America is a common goal because it’s the biggest SaaS market in the world. But beyond that, what are other interesting markets?

M: Latin America, especially Brazil, has been huge for us. Brazilian people just love our product, coincidentally.

The way we expanded was to see where customers come from and then chase the market, rather than break into it our own. Expansion happened organically, and we followed to support it.

We chose not to translate into other languages for a long time, but the Brazilians twisted our arm! So, our second language was Brazilian Portuguese. Now we have 14 different languages.

C: At Paddle, our billing software adds value to our customers when they start to think about selling in other markets. Our expertise in Europe helps our US customers then sell in the EU. And similar to Pipedrive, we adapt to markets based on user requests.

Are there any particularly challenging markets within Europe?

M: Many people talk about Germany’s data privacy laws. Embrace GDPR. We actually have a sizable team managing data privacy. We hired someone early on who took it seriously. If you do it well, it’s a competitive advantage.

C: We think about it in terms of — how do we become the best in the world at being compliant with GDPR?

M: As a European business, you need advantages over the US companies. Salesforce pulled out of the EU because of GDPR, and that was great for us.

“If you handle GDPR well, it’s a competitive advantage.” – Martin Henk, Co-Founder of Pipedrive

What are the strengths of being a European business?

M: As European entrepreneurs, we already have the mindset that there are so many countries and cultures. Just two hours away, the world is completely different, which isn’t the case in the middle of the United States. So, being able to cater to different audiences is a strength.

C: I’ve noticed that in the EU, people talk about “continents and countries.” In the US, people talk about “US and international.”

What do you make of stereotypical criticisms of European SaaS? Such as, “Europeans can’t sell” or, “There are no SaaS execs, just engineers.”

C: Europeans can’t sell? Our growth has been outbound driven since day one. We’ve tripled the business every year, and didn’t get a marketing team until just last year. People in Europe can sell. But I guess we have the same perception of US. There’s a lot of American sales talent that isn’t great.

M: Maybe that was true 10 years ago, but it’s less true today. Concentration of SaaS execs is higher in Silicon Valley, but so is competition. In Europe, you may need to have one VP in Paris and the other in London, but you can find the right candidates.

What are the weaknesses of building company in europe? What do you have to compensate for?

C: A while ago, the weakness was fundraising, access to capital like Series B and C. But not anymore.

There’s also just the perception of being European. (There’s less brand recognition.) From a customer’s standpoint, they struggle to trust their data and money to a small unknown European company.

M: I agree. Getting US companies to pay us in a strange company and currency was a hurdle. Incorporating our business in the US really helped, so they could pay us in dollars and feel confident about our company. Just saying I was based in the Bay Area created a lot more trust. If you take the US seriously, having someone on the ground there makes a big difference.

“If you take the US seriously, having someone on the ground there makes a big difference.” – Martin Henk

Christian, how do you feel about opening an office in the US?

C: We wanted to build substantially in London before removing core people from the team to go open an office in California, for example.

How do you maintain culture when a key founder is no longer there? Once you are more established, the culture is sustaining on its own, and removing original people doesn’t have such a significant impact. If you do expand to the US, it does make sense to move out there to seed the culture in that office.

When you enter a new market, when do you pull out because of CAC?

M: That’s never happened to us. With a self-service product, we don’t get high CAC in new markets.

Martin, what are your thoughts on distributing functional teams in various offices?

M: Nothing is impossible, but some things are ridiculously difficult. Think about the time difference! The main thing is communication. We closed our California office because it was 10 hours behind Estonia. We moved it to NYC because saving those three hours allowed us to have a small overlap of the working day. Take communication seriously, proactively. How will you share information?

Christian, do you have any fears of going global?

C: The same thing — timezones and the collaboration aspect. An argument for expanding earlier is that you get less ingrained processes internally, such as meeting culture. It can be hard to change and adapt at 140 people, trying something for the first time.

Martin, you’ve probably made some mistakes. Is there any one thing you’d change? Any tips for Christian?

M: Changing your mind is a good thing. We opened up a California office and then closed it, but it was necessary to have that office there for a certain period of time. It’s difficult to point to one mistake, because in hindsight you see the benefits of it and what you’ve learned, which is valuable.

My advice is to be more proactive, think ahead. Do seed the culture in new offices.

– Annie

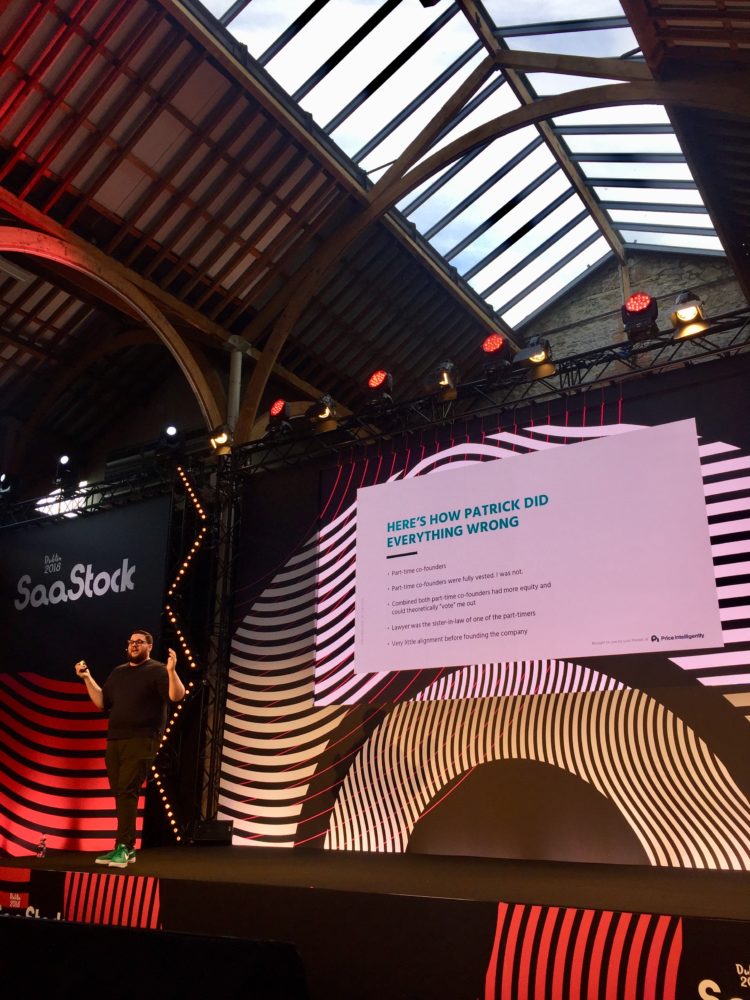

9:50 – Cancer, hardship, and the f*ckery of being a SaaS founder

Patrick Campbell, CEO and Co-founder of Profitwell

Scale Stage

Patrick Campbell is the CEO of ProfitWell (formerly Price Intelligently), the software for helping subscription companies with their monetization and retention strategies. ProfitWell also provides free turnkey subscription financial metrics for over eight thousand companies.

Patrick touched on an issue I’d never heard about before: the dilemmas and pitfalls of having part-time SaaS co-founders.

The lifespan of startups with a part-time co-founder is less than 9 months. Patrick was the only founder working full time; the other two were “part-time” on top of full-time employment elsewhere.

He explained how this dynamic caused extreme hardship for the business and his own well-being.

Structural pain points:

- The part-time founders were fully vested; Patrick was not.

- The two part-time guys could essentially overrule him on any decision — even fire him! — despite the fact that Patrick was the only one full-time.

Morale pain points:

- They were bootstrapping, and he basically felt like a solo founder.

- He got paranoid that they might scheme against him or had ulterior motives.

Ultimately, the imbalance of work commitment among co-founders meant:

- Misaligned expectations

- Different incentives

- Breeding ground for resentment

- Distractions from the business!

What to do about it?

In hindsight, Patrick sees how this terrible situation forced his decisions into different directions:

- Say “fuck these guys!”

- Give them the benefit of the doubt. Follow what he calls the…

The Charitable Interpretation Principle

- Assume that it’s misaligned expectations, not ill intent.

- Assume naivety, not manipulation.

- Instead of breaking it off, talk it out.

- Handle it directly.

Patrick and his two co-founders began to talk through money, expectations, and how to grow. The conversations were difficult, rocky, and uncomfortable. The issues took four years to fix, but the gradual success of the business kept them committed to the solution process.

“Don’t put it off. Problems only get bigger.”

How cancer brought clarity

Next, Patrick turned to a personal experience that illuminated many parts of his life and his business. He had cancer twice while trying to get his company off the ground.

A cancer diagnosis at such a young age forced him to “face the ticking clock” long before most people ever have to. This brought about important existential questions and reflections, which he graciously shared with us this morning.

In short?

“We waste a lot of time because we put up with bullshit.”

We avoid addressing things in our interpersonal relationships or in our business. Let’s stop doing that!

Patrick’s existential ruminations also produced one super pragmatic step for the business.

“Get proper documentation to transfer your role!”

7 out of 10 founders don’t have documentation of their role or how to run the company. If they disappeared, the business would suffer and potentially disappear, too.

Final thoughts from Patrick

If you take a hard look, there’s discord between what you say you want and what you are actually doing.

- Know yourself and what you want.

- You can’t be everything to all people.

- You can choose your friends.

- You can choose what you want.

- Be what you want, but be honest about it.

Do you want hyper-growth, or financial security with some hobbies on the side? Both are GREAT, but you have to find the clarity on your own.

And once you do, embrace it.

– Annie

9:20 – Massive scale, escape velocity: The secrets behind Slack’s success

Cal Henderson, CTO of Slack

Philippe Botteri, Partner at Accel

How to architect your infrastructure to scale big and fast is one of the most important issues in managing (and preparing for) hypergrowth.

We’re examining the “Dos and Don’ts,” alongside key challenges and how to overcome them. We’re also tackling the tricky topic of scaling your engineering team: the organization and hiring processes you’ll need to implement and the most important questions to ask an engineer. Cal’s sharing his journey, from the rough to the smooth, the lessons he’s learned along the way, and the one piece of advice he’d give to a founder launching a cloud business today.

9:00 AM Start of Day2 and some exciting announcements