From the largest ever ‘startup’ deal (OpenAI’s $40 billion round) to the largest ever acquisition of a private company (Google’s $32 billion purchase of SaaS cloud security company Wiz), Q1 delivered its fair share of headline-grabbing funding news.

But what else happened? And what do these financial moves tell us about the year ahead?

In this post, we’re digging into the stats – recapping the key SaaS deals, valuations and acquisitions from Q1, and highlighting what SaaS companies are spending their investments on.

Q1 SaaS deals

First, the good news: SaaS remains a popular investment – no matter the stage of growth.

In Q1, there were SaaS funding deals across the growth-stage spectrum, including:

- Quantexa’s $175 million Series F,

- Medical platform The Helper Bees’ $35 million Series C,

- Business communications platform LeapXpert’s $20 million Series B,

- And billing solution Anchor’s $20 million Series A.

There was also a range of deals at the Pre-Seed/Seed level such as Genesy AI’s €5 million Seed round.

Although this continued investment shows an ongoing appetite for SaaS business models, venture capital was not equally deployed. For instance, the SaaS VC Report 2025 showed that in 2024:

- Total VC investment ($125 billion) was 29% higher than 2023, but with 18% less deals (8,188).

- The median revenue multiple for SaaS investments dropped to 10.1x (from 11.3x in 2023) with median investments for Series A ($12M), Series B ($30M) and Series C ($35M).

- Fintech, Cybersecurity and AI-driven SaaS attracted the most venture capital, with AI companies accounting for 37% of VC funding.

AI is never too far from SaaS funding conversations and given the size of AI deals in Q1 (150+ AI-focused startups raised over $5billion while the likes of Anthropic raised $3.5 billion alone), AI-focused SaaS looks likely to attract the most capital in 2025 too.

Q1 SaaS valuations

Thanks to recurring revenue streams, SaaS companies command higher multiples and valuations than many other industries. In 2024, the median revenue multiple for VC-backed SaaS hovered around 10xARR. But that does not tell the full picture.

According to Sammy Abdullah, Co-Founder of Blossom Street Ventures, SaaS multiples ‘fell hard’ in Q1 for publicly-traded SaaS:

- The median multiple was 5.8x revenue.

- The average was 8x revenue.

- Only 23% of companies were trading at over 10x revenue (compared to 60% in Q4 2020).

But private SaaS didn’t fare much better, despite tending to grow quicker, with SaaS valuations ranging from 3x to 10x depending on the growth rate and industry.

- Companies with less than 20% ARR attracted multiples of 3-5xARR.

- Companies with 40%+ ARR growth achieved 7-10x multiples.

- Sectors like enterprise resource planning (6.6x) earned higher multiples than advertising tech (4.5x).

Q1 SaaS M&A

Last year, SaaS M&A was 18% higher than 2021 – but will this trend continue in 2025?

According to recent analysis by Development Corporate, the ‘lower-middle market’ SaaS, which includes Pre-Seed and Seed stages, will be particularly attractive M&A propositions in 2025 “due to the combination of potentially lower valuations and significant growth opportunities achievable through strategic roll-ups and operational enhancements.”

But Q1 M&A also took place at later stages and further away from traditional SaaS hubs. For instance, M&A was used to:

- Strengthen cybersecurity and AI capabilities – e.g. Google’s $32billion acquisition of Wiz to improve its cloud security offering.

- Expand globally – e.g. Airwallex’s purchase of CTIN Pay, a Vietnamese payment company, to speed up APAC expansion.

- Move into the EU – e.g. LemFI acquisition of Bureau Buttercrane, an Irish currency exchange platform, to get an EU licence.

However, recent tariff uncertainty is expected to see a general slowdown in M&A activity over the next few months, even for primarily digital companies like SaaS.

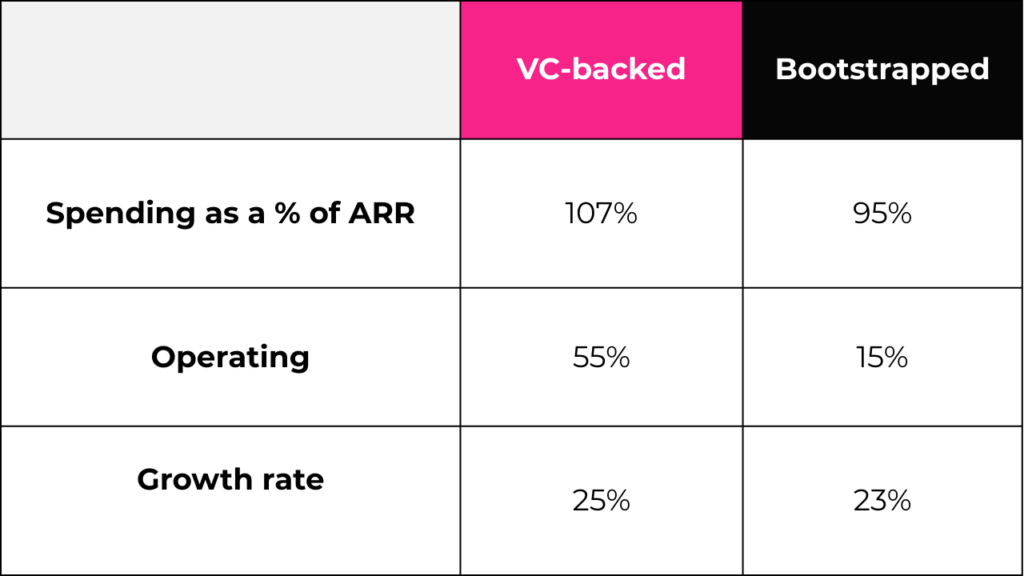

Q1 SaaS spending: VC-backed vs bootstrapped

Funding received, it’s time to spend. But what are VC-backed SaaS spending their money on and how does this compare to their bootstrapped rivals?

SaaS Capital conducted a survey of Q1 SaaS spending and found:

For both types of SaaS company, the main departmental cost was R&D (22%), while the clearest difference between them was VC-backed SaaS spending 100% more on marketing and 89% more on sales than bootstrapped companies.

AI developments over the course of 2025 may also shake up the VC vs bootstrapped match-up, with bootstrapped organisations now able to achieve more with less capital.

The year ahead

In the last two weeks, 2025’s economic picture has gotten a lot murkier thanks to tariff-shaped uncertainty. How this affects the AI transition, SaaS operations and access to funding remains to be seen, but stay tuned to SaaStock events, articles, and our podcast for the latest.

This post was originally published in the SaaStock Blueprint newsletter. Subscribe to get insights like this directly to your inbox.