This is a sponsored post by AWS, written by Afza Wajid, Bill Tarr, and Tomaz Perc.

Software as a service (SaaS) can be an effective strategy for delivering accelerated growth and increasing the value of a business. This is reflected in publicly traded SaaS companies consistently outperforming market indices such as the NASDAQ and the S&P 500, and by a fivefold increase in venture capital investment in SaaS (per Crunchbase data analysis) over the last decade. Yet market analysis indicates that SaaS companies take a median of 7-10 years to reach $100M in annual recurring revenue.

In this article, we discuss a set of operational levers that the AWS SaaS Factory Program recommends to accelerate early-stage SaaS growth while still laying the foundation for a sustainable SaaS business. To illustrate, we include examples of key business decisions and learnings from AWS Partners that have achieved breakout success.

1. Prioritize the product roadmap meticulously, with a focus on delivering long-term growth.

In SaaS, there is no concept of shipping a “final product”. The emphasis on agility, rapid innovation, and shorter time to value necessitates getting to market quickly with a minimum viable product (MVP) and then refining the product roadmap based on customer usage patterns and evolving market dynamics. With the expectation of shorter development cycles and frequent releases, it is imperative to meticulously prioritize the most valuable use cases for the business and solve these better and faster than the competition.

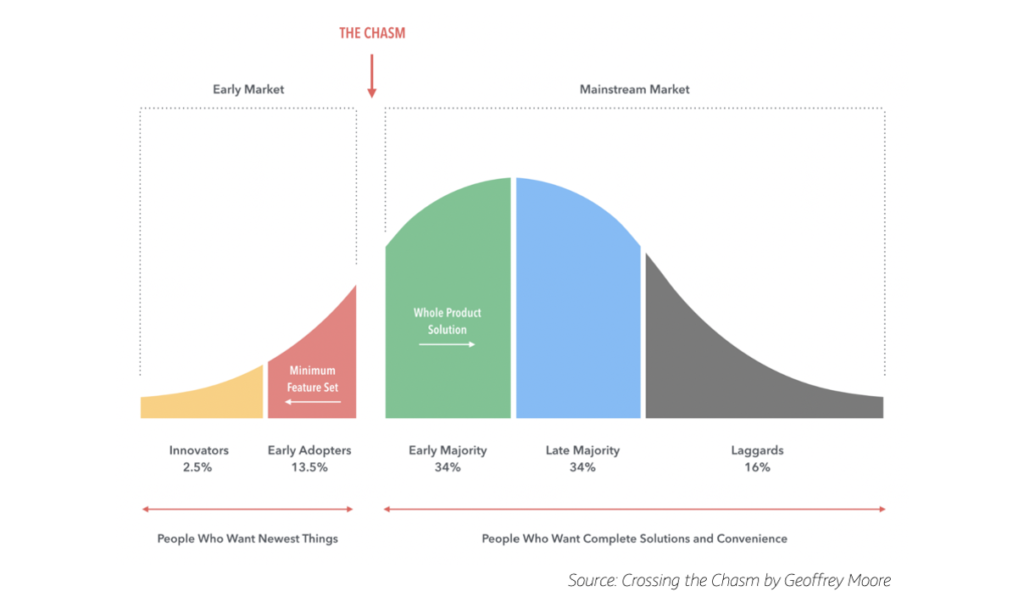

For example, Clumio, a data backup and recovery startup, made a key early product decision to pivot away from a broader set of use cases. Instead, it chose to focus exclusively on data protection for next-generation cloud-based workloads, including native AWS workloads and VMware Cloud workloads hosted on AWS. In conversation with AWS SaaS Factory, Clumio’s cofounder and CEO Poojan Kumar observed, “It’s not a question of if; it’s more a question of when [companies make the transition to cloud]”. Kumar relates the journey to cloud for many customers as akin to “crossing the chasm”, as described in Geoffrey Moore’s book of the same name. If market dynamics permit, companies can avoid the chasm by starting with the innovators and early-adopters, rather than expending resources on building for or converting the late majority. Staying true to this vision has meant walking away from significant customer deals that didn’t align with the company’s long-term growth objectives. But the opportunity cost of having a lean team focus on transient wins was deemed too high by Clumio’s seasoned leadership. Clumio is valued at US$785 million based on a US$135 million Series C funding round in November 2019.

2. Develop a phased customer strategy to quickly establish product-market fit and build reference-ability.

Before pushing to scale the business, companies can more quickly validate and refine their products by narrowing the focus to a specific segment, vertical, or geography. Weave, a patient communications software startup, began by selling its SaaS offering exclusively to dental practices. This focus helped the company grow tremendously within its first vertical and validate its use case. Weave could then bring the solution to other verticals in the small and midsize business (SMB) segment, effectively expanding its total addressable market. The company is valued at $970 million, based on a $70 million Series D funding round in October 2019.

While keeping the focus narrow in the early stages may seem counterintuitive, especially given that expanded customer reach is a key value driver in SaaS, there are two reasons to take this approach. First, you may be able to deliver a product aimed at (or excluding) specific market segments sooner. For example, a company could deliver to non-healthcare verticals before becoming Health Insurance Portability and Accountability Act (HIPAA) certified to offer to healthcare customers in the United States. Second, different segments, verticals, and geographies will have their own nuances that must be addressed for early adopters to become the delighted customer advocates instrumental to driving exponential growth in the early stages.

3. Optimize the experience for key user personas to drive greater product engagement.

Of the more than 2200 business buyers surveyed for Salesforce’s State of the Connected Consumer Report (third edition), 89 percent said that user experience is as important as the product or service. In fact, 82 percent were willing to pay more for a great experience and 77 percent were open to the use of artificial intelligence to improve the overall experience. SaaS providers have a bidirectional link to end users, and thereby the ability to deliver personalized experiences based on user preferences and product usage patterns. An effective approach to optimizing the user experience is mapping the end-to-end customer journey and refining specific customer-service interactions for primary target personas, starting with initial contact to purchase, usage, advocacy, and upgrades (or churn).

Because SaaS emphasizes a user-centric approach, building for strategic personas is a critical success factor. In a panel discussion hosted by AWS SaaS Factory, Stripe’s Head of Platform Sales Kate Jensen highlighted that Stripe built for the developer persona from the outset. “Developers started to build on Stripe, and really loved building on our technology, where not only [were] our APIs very easy to use, but our documentation was robust and referenceable, so people knew actually what would happen once they started coding to our API”. Stripe has since expanded this core to an array of use cases, reaching a valuation of US$95 billion based on the US$600 million Series H funding round raised in March 2021.

4. Architect for agility and cost efficiency in alignment with business objectives.

With the emphasis on agility, smaller deployments, and zero-downtime maintenance and upgrades, architecting for SaaS merits a shift away from conventional monolithic models to modern architectures such as loosely coupled microservices. With the array of managed cloud services available, selecting suitable technologies for each element of the architecture is pivotal. Silicon Valley–based identity management company Inflection Risk Solutions chose a serverless architecture over containers-based as the technology to enable the lean startup to move fastest. Discussing his rationale, CTO Siddharth Ram cites agility, lower barriers to proficiency, and reduced operational burden for this decision.

Additionally, because the cost of operating the service and business compliance are directly determined by the technical architecture and deployment strategy, both must be aligned with the customer use case and target business objectives. Manufacturing software company iBASEt serves customers in highly regulated verticals such as aerospace and defense, which must comply with International Traffic in Arms Regulations (ITAR). To serve a segment with specific regulatory requirements, iBASEt architected its cloud-based manufacturing execution system in a silo SaaS model where each tenant has its own resource stack, with AWS GovCloud (US) as the default hosting option. CTO Sung Kim highlights that delivering in a SaaS model has accelerated time to value for iBASEt’s customers while facilitating full compliance with government regulations.

Validating that an architecture aligns with business objectives includes assessing its operational excellence, security, reliability, performance efficiency, and cost optimization. Best practices for achieving these objectives can be found in the AWS “SaaS Lens” Well-Architected Review.

5. Address the spectrum of purchase preferences with a flexible and growth-focused pricing strategy.

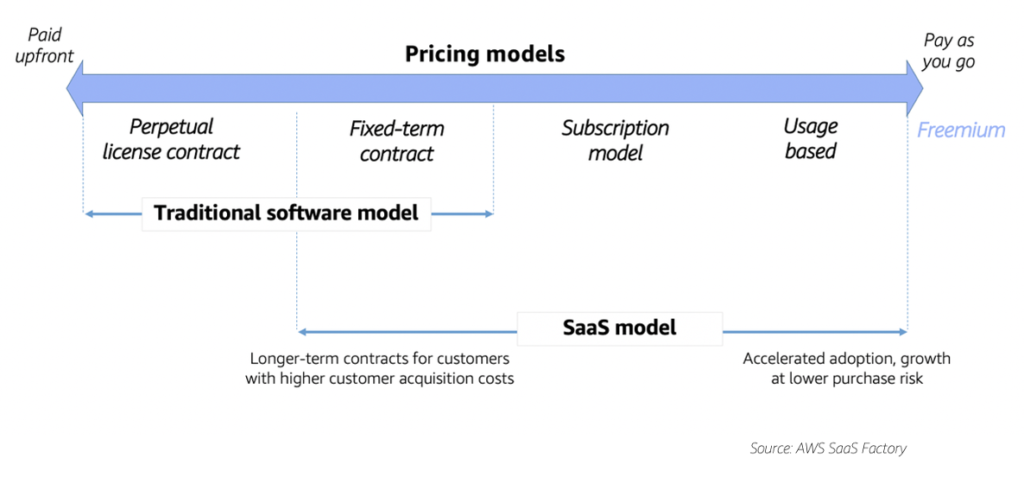

Early-stage pricing is centered on customer acquisition. Low-risk purchase options such as usage-based pricing or subscriptions with no commitment accelerate product adoption and lower the initial customer acquisition cost (CAC). Even so, longer-term contracts may have better odds of revenue retention and a higher overall customer lifetime value (LTV). Leading with flexible tiered pricing, while incentivizing longer-term contractual commitment may be a balanced approach to maximize the LTV-to-CAC ratio. At the far end of the accelerated adoption spectrum is the “freemium” model (distinct from a free trial), which can be highly effective as a customer acquisition strategy. However, it can also be costly, and requires definitive conversion mechanisms to be successful.

At the heart of growth-focused pricing is the selection of a “pricing unit” such that value to the customer grows with usage. A pricing unit may be based on a single dimension (e.g., compute, storage, users, or features) or a combination thereof. Over 65% of all SaaS businesses listed on AWS Marketplace use a composite billing dimension. One common early-stage pitfall is pricing disruptive innovation based on cost or in line with competition. While cost may serve as the lower bound, businesses may be better served taking a value-based approach and continually optimizing pricing.

Dremio, a Series D funded unicorn startup, serves both large enterprises and venture-backed startups. Speaking with AWS SaaS Factory, cofounder Tomer Shiran noted that his company has adopted a flexible, usage-based pricing strategy for customers across all segments to ensure bidirectional scalability of Dremio Cloud, its fully managed SQL lakehouse platform. Dremio offers both a freemium tier for early-stage customers and a time-limited free trial with the option to convert to consumption-based contracts for mature customers. Dremio bills consumption by Dremio Compute Units, where customers pay for the amount of compute usage.

6. Lead with the product to land and expand with customers.

A SaaS sales model is iterative. That is, a customer may initially sign up for a lower tier of service and then circle back to evaluate new features or upgrade to a higher tier of service (or churn, if unhappy). In conversation with AWS SaaS Factory, Snowflake’s SVP of worldwide partner and alliances, Colleen Kapase, emphasizes, “It didn’t start with … multimillion-dollar deals.” Snowflake led with its product, adopting a “land-and-expand” strategy so that customers could experience firsthand the power of the product. “When data queries that took days or longer were now completed in seconds … and customers were able to make business decisions faster, word spread organically and that caught on like wildfire.” In October 2020, eight years after its founding, Snowflake made history as the largest initial public offering for a software company in the United States, reaching a market capitalization of nearly US$75 billion on opening day. Kapase’s advice is simple: “Get in there and have your customers use [the] product.”

An effective product-led growth strategy relies on an efficient, metrics-driven customer success function that can deliver timely, customized, and automated intervention to improve engagement. A well implemented customer success program commonly includes trial access to relevant new features or premium-tier functionality, in-product communications to prompt user action, training for users who may be underutilizing the service, and remediation to unhappy customers to preempt churn.

7. Engage a comprehensive partner ecosystem to accelerate revenue growth.

A broad and engaged partner network is a powerful sales accelerator. Almost 70 percent of B2B SaaS companies are reported to have a channel partner program, and over 20 percent of their revenue is estimated to come through the channel. Investing early in developing a comprehensive alliances and channel strategy—comprising technology partners, system integrators, resellers, influencers, and advocates—can be a growth flywheel.

Founded in 2011, cybersecurity solutions provider CrowdStrike is valued at US$58 billion (as of September 2021). Speaking with AWS SaaS Factory, CrowdStrike’s VP of cloud product sales and alliances Jessica Alexander highlighted the company’s partnership with AWS and the early success with AWS Marketplace through private offers and enterprise contracts, observing that “transactions are 33 percent faster when they go through AWS Marketplace.” CrowdStrike also leverages AWS Partner Network (APN) programs such as AWS ISV Accelerate and APN Customer Engagements (ACE) to encourage field teams from CrowdStrike and AWS to work together to drive collaborative sales. In addition, the company has built a series of service-level integrations with partner solutions to accelerate customer onboarding.

CrowdStrike also offers its own CrowdStrike Elevate Partner Program, which includes technology partners, system integrators, solutions providers, resellers, and more. With a channel-first approach, the company seeks to further engage its channel partners into transactions and sales motion to fully leverage the power of the cloud go-to-market.

8. Achieve reliability and operational efficiency through DevOps and RevOps best practices.

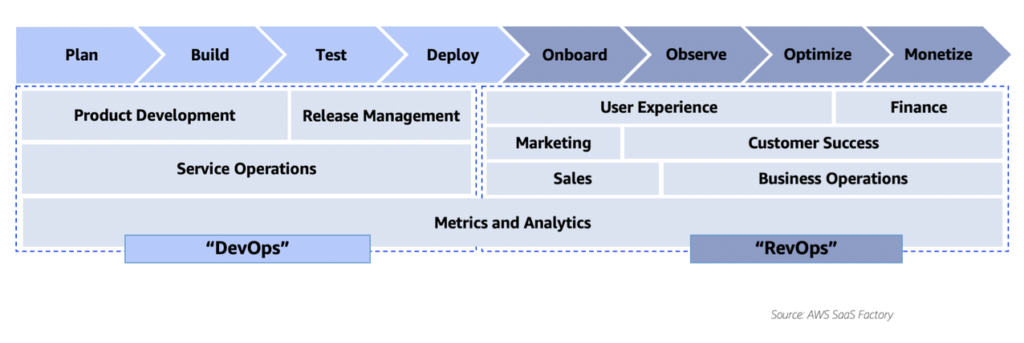

In SaaS, operating the service “is” the business. Delivering agile innovation with reliability requires robust operational processes for release management, customer onboarding, and observability. DevOps best practices–including code to cloud automation, deployment strategies such as canary releases, blue/green deployments, and dark launching, and maintaining a single deployed version of the software–ensure a stable and repeatable SaaS environment and dependability of deployments. Operational and product usage metrics surfaced through business intelligence tools afford observability for an optimal user experience.

The dynamic nature of SaaS sales requires ongoing cost optimization and revenue management. IDC Research has reported that growing SaaS businesses lose 20-30% of their revenue to operational inefficiencies. An efficient revenue operations (RevOps) function–enabled by linking disparate business systems for consistency in data and metrics across departments, aligning revenue with consumption costs, and identifying gaps in the customer journey that may be resulting in lost revenue–allows ongoing auditing of the revenue stack to identify and resolve inefficiencies in the revenue stream.

Series E–funded startup Cohesity offers a Data Management as a Service (DMaaS) suite that includes backup, archiving, disaster recovery, data governance, and other services. Ahead of the DMaaS launch, Cohesity prioritized a fully automated CI/CD flow with metrics guiding each stage of the pipeline, reducing production deployment time from months to weeks. Real-time metrics for infrastructure events and customer SLAs are made available to supporting teams through alerts and dashboards for visibility and rapid resolution. Instrumentation and visualization tools enable product usage observability and quick identification of friction points in the user experience.

Cohesity integrated sales and contracting processes and the synchronization of customer entitlements through backend systems that work with AWS Marketplace and billing systems. This creates a seamless experience for customers to participate in free trials and sign up for DMaaS via multiple options. Inline help and an integrated chatbot simplify onboarding, facilitate self-guided troubleshooting, and link to backend systems for efficient customer support. Founded in 2013, Cohesity is valued at US$3.7 billion per a March 2021 equity deal.

9. Appreciate the investor’s approach to assessing early-stage breakout success.

Investors value businesses differently at various stages of the lifecycle. In conversation with AWS SaaS Factory, Crosslink Capital Partner Phil Boyer notes, “Very early on, there aren’t a lot of metrics. It’s more about assessing the team, idea, and market opportunity. As the company evolves to reach subsequent growth milestones, metrics become increasingly important.” The founding team’s unique insight into the market to know what is viable yet groundbreaking is highly valuable because that makes it difficult for others to replicate. Boyer emphasizes strong leadership as an early differentiator for breakout companies, especially a strong visionary CEO who can attract a great team and get employees, investors, and customers to rally around the vision and mission.

Early investors also assess the team’s strategy for building business defensibility in the long-term. Defensibility strategies include adopting a product-led or open-source strategy that nurtures a community that is hard to replicate, building a network effect that makes the product or ecosystem more valuable over time, creating a distribution advantage with a unique channel strategy, or building a data moat around the business. Intellectual property is a more traditional mechanism of defensibility, but others usually catch up over time.

“As the company graduates from each stage, the company, the team, the product, and the go-to-market strategy must all continue to evolve,” says Boyer. “That’s where experience becomes important–being able to recruit for those specialists to place around the CEO in the core founding team to take the company to the next level.”

10. Balance relentless focus and resiliency with adaptability to pivot in a crisis.

Keeping a relentless focus on the mission of the company is important. However, realizing when the company must change course and being able to pivot quickly are factors that distinguish companies, and indicate that the company will be able to sustain high growth throughout its life cycle.

For corporate travel management startup, TripActions, the COVID-19 pandemic brought the industry that generated its revenue to a dead stop. TripActions quickly pivoted, helping customers get back home and navigate travel during the pandemic. Because dispersed corporate employees would be expensing home office equipment and virtual software, TripActions accelerated the timeline for its new fintech expense solution, TripActions Liquid—broadening the types of expenses accepted, providing near-real-time visibility into business spending, and facilitating instantaneous policy adjustments to provide access to funds at all times. This remarkable turnaround, led by cofounder and CEO Ariel Cohen, has seen revenue recover to pre-pandemic levels and valuation grow to US$7.25 billion, based on a Series F funding round of US$280 million that was completed in October 2021.*

In conclusion, while accelerating SaaS growth may look seamless and easy from the outside, it’s never a straight line, even with the most successful companies. It takes incredible resiliency and undeniable conviction to make it through those challenging times and continue the journey to build a category-defining product.

*Source: Pitchbook

About AWS SaaS Factory

AWS SaaS Factory provides business and technical advisory to organizations at any stage of the SaaS journey. Whether looking to build new products, migrate existing applications, or optimize SaaS solutions on AWS, the AWS SaaS Factory Program can help. Please reach out to your AWS account representative to inquire about engaging AWS SaaS Factory.

Sign up to stay informed about the latest SaaS on AWS news, resources, and events.

Are you an early-stage founder looking to grow your SaaS?

The SaaStock Founder Membership is a private community of ambitious SaaS founders where you can get a support network of peers, connect with likeminded founders around the globe, and learn proven strategies from industry experts to help you scale up your SaaS.

Get access to a global network of likeminded founders, peer groups, expert-led workshops, and more to help you scale faster together.

Visit saastock.com/founder-membership to apply.