When it comes to SaaS, the market in the United States is renowned for being a leader among nations.

Home to over 8x more SaaS companies than anywhere else in the world (The Latka Agency), the SaaS market in the US is set to double in the next two years (Reply)… and it doesn’t stop there.

As of this year SaaS has an estimated worth of $195 billion (Exploding Topics), and according to experts, that number is only going to increase. We’re predicted to see a continued state of growth and innovation in the SaaS market throughout the US, with forecasts that there will be a 40% year-over-year growth on company B2B SaaS spend (Gartner) – taking us from the current $145 billion SaaS spend per year to a whopping $203 billion dollar spend by the close of 2023.

The numbers speak for themselves: the past few years have seen a significant increase in demand for SaaS solutions as businesses of all sizes have sought to streamline their operations and improve their competitiveness in the digital age.

While it’s true that industry growth is predicted to continue in an upward trend, the looming economic difficulties will pose a new set of challenges for SaaS businesses looking to beat the competition. This piece highlights the six major focus areas SaaS founders need to build their business strategy around should they wish to thrive over the next 24 months.

A key driver for the ongoing growth surge has been the ongoing shift towards remote work, which accelerated in the wake of COVID-19 and has continued to establish itself in company operations thereafter.

There are two elements within the realm of remote work that have contributed to this growth: process and people. With more of us working from home and relying on digital tools to stay connected, the first contributor to growth has been the huge increase in demand for the SaaS products that help organisations manage remote teams and keep operations running smoothly. The second most commonly used SaaS tool with a 13.3% usage rate (Cledara), it’s predicted that by 2026 the market for digital collaboration tools will grow to $20.8 billion; that’s a compound annual growth rate of 1.6%! (Apps Run the World).

The second contributor and the first area of focus for SaaS founders: the talent of the team itself. Rory Brown, Founder & CCO of Kluster, summaries the apprehension too many companies hold when it comes to hiring in times of economic uncertainty, saying “attracting top talent has definitely become more difficult. When the market is unpredictable, people are more likely to have a mentality of ‘I’m doing well, this isn’t the time to make a calculated risk’” (SolutionsDriven).

Recruiting and retaining talent has never been easy but building a rockstar team is one of few drivers of success that will never fail. Now, moving from the struggles COVID-19 imposed on businesses to the looming uphill battle the economy is set to deliver, SaaS needs to double-down on the quality of the people behind the product.

From creating well balanced hiring plans to showcasing a unified vision, having the right people on the journey is the first step to paving the way for SaaS success.

Another factor contributing to the growth of the US SaaS market is the increasing popularity of cloud computing. With a 16.3% compound annual growth rate, experts predict that the global cloud computing market, which is the umbrella industry of SaaS, will be worth up to $947.3 billion in the next three years (Markets and Markets).

As more businesses move their IT infrastructure to the cloud, they are finding that SaaS solutions are an effective way to streamline processes, reduce costs, and improve the overall user experience. While this has led to a proliferation of new SaaS products and services, many of which are designed to integrate with existing cloud platforms like Amazon Web Services (AWS) and Microsoft Azure, the second key area for SaaS founders to consider is how these businesses are using SaaS solutions to improve their customer experience and communications, and drive transitional growth. A study by Gartner estimates that 89% of businesses will heavily rely on their customer experience in order to beat the competition – meaning that now more than ever, founders and their teams need to do the utmost in order to deliver maximum impact to their customers. With some of the world’s leading SaaS companies ramping up their media content and testing new techniques, effective out-of-the-box campaign strategies are how customers will ultimately be brought to the point of sale. For those companies to truly stand the test of time and grow through the market’s turmoil, founders will need to think strategically about their customers, campaigns, and competition in order to achieve stable growth.

8 US SaaS Companies raising the bar

ZenBusiness

5-year search growth increase: 3,300%

Founded in: 2015

Based in: Austin, Texas

Funding: $277M (Series Unknown)

A PBC (public benefit corporation) ZenBusiness’ mission is to enable anyone to start, run, and grow their business while avoiding the common pitfalls that derail hopeful entrepreneurs. No more having to wade through forms, taxes, or ongoing state compliance. In November 2021, the company announced a $200M funding round, reached a valuation of $1.7B, and publicised a new partnership with well-known businessman Mark Cuban.

Printify

5-year search growth increase: 1,257%

Founded in: 2015

Based in: San Francisco, California

Funding: $54.1M (Series A)

Printify believes that everyone should have a risk-free chance to build a business selling top-quality merchandise. Their platform brings together merchants and the world’s top printing houses to power a new generation of eCommerce stores. Printify brought in $45M in an H2 2021 Series A funding round from Index Ventures, H&M Group, and even Will Smith’s own investment firm.

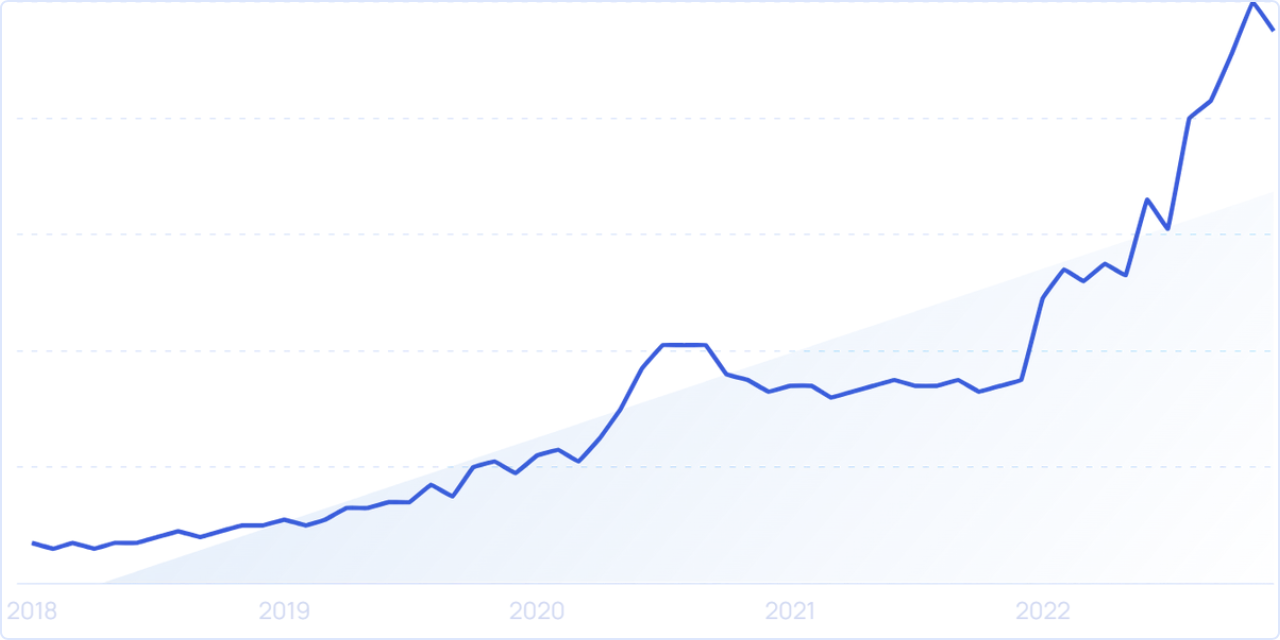

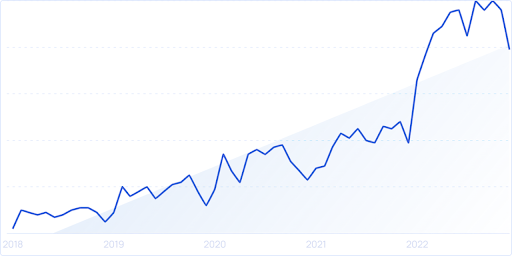

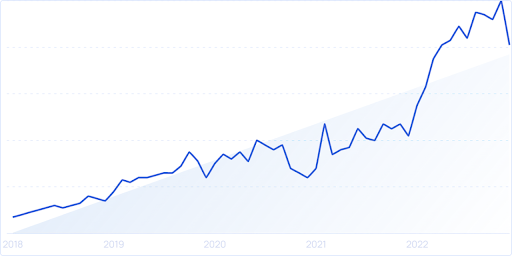

Image from Exploding Topics: 40 Skyrocketing SaaS Companies & Startups (2023)

Adalo

5-year search growth increase: 9200%

Founded in: 2018

Based in: St Louis, Missouri

Funding: $9.8M (Series A)

Adalo empowers makers to bring their ideas to life. An in-app building platform, creatives, business owners, and founders create custom web & mobile applications without code. Adalo recently received $8M in a Series A funding round with investment firm Tiger Global (known for being a ‘unicorn-hunter’) leading the pack.

Lokalise

5-year search growth increase: 483%

Founded in: 2017

Based in: Dover, Delaware

Funding: $56M (Series B)

A localization and translation management platform for agile teams, Lokalise provides a cloud platform for users to manage the translations of mobile apps, games, websites – either on their own or with a team of collaborators. A global study by CSA Research showed that 76% of people are more likely to buy goods or services online from a provider that communicates with them in their own language.

ClickUp

5-year search growth increase: 3,850%

Year founded: 2017

Based in: San Diego, California

Funding: $537.5M (Series C)

A productivity platform for scheduling tasks, streamlining communication, and more, ClickUp is trusted by over 800k teams around the world. Zeb Evans, ClickUp’s Founder & CEO, joined us on the SaaStock 2022 stage to discuss how the company grew to over 6M users in five years; sharing how they built a globally recognized brand, developed an innovative product, and cultivated a strong company culture. ClickUp is now valued at over $4 billion.

Image from Exploding Topics: 40 Skyrocketing SaaS Companies & Startups (2023)

Fieldwire

5-year search growth increase: 105%

Founded in: 2013

Based in: San Francisco, California

Funding: $41.2M (Series C)

Disrupting the long-held belief that construction is an old-fashioned industry, Fieldwire’s platform gives construction crews a single source of truth for their data while on a project: checklists, inspections, real-time messaging, scheduling, and more. What’s more, users are able to create markups and edit building layouts digitally on iPads or mobile devices.

Notion

5-year search growth increase: 1,460%

Founded in: 2013

Based in: San Francisco, California

Funding: $343.2M (Series C)

A productivity platform that allows companies to customise their processes and workflows, Notion can be used to create and collaborate on product roadmaps, organise meeting notes, hold documents, and more. Funded by 30 investors, Notion was most recently valued at $4.2M.

DataBricks

5-year search growth increase: 1057%

Founded in: 2013

Based in: San Francisco, California

Funding: $3.5B (Series H)

Databricks is a technology startup focused on helping companies leverage data to provide insights and drive decision-making across multiple industries and areas. The startup has gained popularity with well-known brands (Conde Nast, Adobe, Biogen, and H&M) and investors alike and recently announced a Series H funding round that amounted to a staggering $1.6B.

Image from Exploding Topics: 40 Skyrocketing SaaS Companies & Startups (2023)

In an effort to further grow and scale their business, SaaS will focus on sales-led revenue operations. The hurdle presented here lies in the intersection of customers having more information than ever before and an even higher unwillingness to be ‘sold to’.

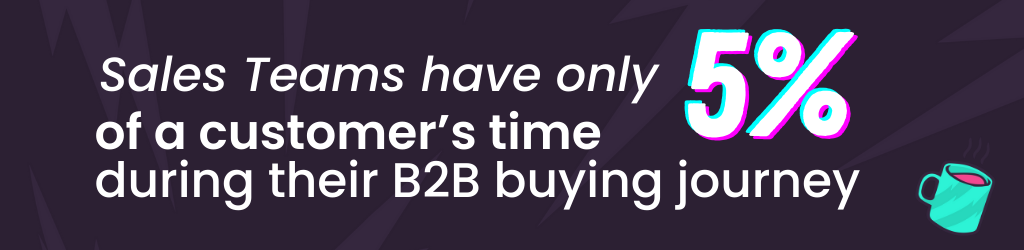

It’s reported that sales teams have a mere 5% of a customer’s time during their B2B buying journey (Gartner). Combined with the market-led impacts such as longer sales cycles, changes in decision makers and tighter spending, knowing the ins and outs of the market, a company’s processes and the customers’ position in the buying journey is essential for teams wanting to capitalize on that small but mighty 5%.

Sales-led revenue operations have the potential to fuel some much needed growth for 2023 – but only if the correct internal teams and tools are aligned.

If any press is good press then by the same token any growth is good growth… But not quite.

The fourth area of focus for SaaS founders and the critical difference that will separate the strongest of the 17,000+ US based SaaS companies (Exploding Topics) apart from the others is those that are able to achieve sustainable, long-term growth. SaaS founders across the US will need to spend a large part of the year focusing on how they can scale their business consistently and sustainably.

According to Kristina Shen, General Partner at private American venture capital firm Andreessen Horowitz, the answer for how SaaS businesses can weather hard times is simple: “in a volatile market, SaaS businesses should focus on efficiency before growth” (Andreessen Horowitz). With tough conditions on the horizon for SaaS businesses around the world, the former may lead to the latter but the same can’t necessarily be said in reverse. Companies will need to decide whether or not they are prepared for expansion and what the impact of that reality has on their operations. From constantly refining their product to hitting the next milestone, US SaaS founders will have a much higher chance of reaching success if efficiency is at the heart of their business.

The latest – and some may argue greatest – route to growth is going down the path of PLG (Product-Led Growth). Coined in 2016, many believed it was the future of SaaS and attempted to adopt an effective PLG growth strategy.

The fifth area of focus for SaaS founders this year is often hailed as the ‘modern GTM’ (Go To Market), and with good merit: PLG companies show 80% higher revenue multipliers and grow faster than traditional companies (Amplitude). What’s more, OpenView, an expansion stage venture firm, found that product-led businesses are valued more than 30% higher than the public-market SaaS Index Fund (6Sense). The data speaks for itself – with seemingly limitless upside potential, founders will need to dually prioritize not only their operational efficiency but also how to effectively position, execute and benchmark their business for some serious product-led growth.

Despite the growth the SaaS market has seen, hurdles still remain. One of the biggest challenges facing US based SaaS companies in 2023 is the need to integrate new systems with existing IT infrastructure – something that is oftentimes complex and time-consuming. Additionally, some organizations are hesitant to adopt SaaS solutions due to concerns around security and data privacy.

To address these challenges many SaaS providers are investing in new technologies and features that can help organizations integrate their systems and protect their data. For example, some companies are developing integrations with popular project management tools like Asana and Trello, while others are incorporating machine learning and AI technologies to help businesses make more informed decisions and automate repetitive tasks.

How can those facing these hurdles begin to get past them? Like it or not, the sixth area of focus all comes down to one thing: capital.

While many experts predict that SaaS in the US will continue to grow for the foreseeable future, the one key element any particular SaaS company needs in order to truly thrive is funding. Recent headlines have had it all; slowing investment activity, VCs becoming more risk-averse; there’s more pressure than ever for companies to improve their capital efficiency.

But, despite the headlines, if there’s one thing the SaaS market will always have going for it, it’s VCs looking to make their next investment.

Bret Wistrom, Editor at Austin Inno, confirms that when it comes to deals and dollars, US SaaS investment – and those Texas-based in particular – remains strong; “Austin’s venture capital ecosystem is booming, as many of the metro’s relatively new firms continue to land big returns on their tech startup investments.” (BizJournals). Whether bootstrapped or looking to raise capital, SaaS businesses will need to establish what actually matters to investors in 2023 and what adjustments need to be made to secure the funding that unlocks their next wave of growth.

All in all, the state of the SaaS market in the US in 2023 is one of growth, innovation, and increasing importance. Whether it’s a small business looking to improve their workflow or a large enterprise hoping to streamline their operations, SaaS solutions are an essential element.

SaaS Experts to Follow

For SaaS founders looking to truly weather the upcoming storm and come out stronger than ever, it’s paramount that they stick to the focus areas mentioned above when reevaluating their business strategy for 2023 and beyond.

- Anthony Kennada, Co-founder & CEO, AudiencePlus

- Eli Rubel, CEO, Matter Made

- Sanjiv Kalevar, Partner, OpenView

- Peep Laja, Founder & CEO, Wynter

- Dave Kellogg, Principal, Dave Kellogg Consulting

- Dave Grow, CEO, Lucid Software

- Tae Hea Nahm, Co-founder & Managing Director, Storm Ventures

- Carolyn Betts, Founder & CEO, Betts

- Kevin Dorsey, SVP Sales, Bench

- Patricia McLaren, Co-founder & CEO, RevShoppe

- Roy Solomon, Co-founder & CEO, Salesroom

- Cathy Gao, Partner, Sapphire Ventures

- Chris Walker, CEO, Refine Labs

Europe’s hottest SaaS Festival in Austin

Taking place at the Austin Marriott Downtown, May 31st – June 2nd, SaaStock USA will bring together 800+ founders, investors and a whole lotta SaaS.

- 3 day in-person conference

- Where we bring together the highest Concentration of SaaS decision-makers

- 800+ Attendees (400+ SaaS Founders and 100+ SaaS-focused Investors)

- We facilitate human connections, not just meetings

- Actionable Content for every company stage

- Hand-picked speakers who’ve proven themselves to be world class leaders, trendsetters and disruptors in SaaS.

SaaStock attendees, speakers and sponsors include the likes of Vitally, &Open, Vanta, ProfitWell by Paddle, Intercom, Accel, Founderpath, Stripe, UiPath, TripActions, Clickup.